9 Best Cash Flow Planning Software & Management Tools 2024

Cash flow management is a fundamental aspect of any successful business.

However, keeping track of cash flow manually can be a time-consuming and tedious process. This is where cash flow planning software comes in.

With a wide range of features, from real-time data to forecasting and reporting tools, cash flow planning and management software can streamline and simplify your cash management processes.

In this article, we will review some of the best cash flow planning software options available, including their key features, pros and cons, pricing, and our bottom-line recommendation, to help you make an informed decision.

What Are The Best Cash Flow Planning Software?

Here are the best cash flow planning softwares for cash flow management.

1. Causal

Causal is a cloud-based software designed for financial modelling and scenario planning. It offers a user-friendly platform to build models, connect them to data, and share them with interactive dashboards and visuals.

By replacing traditional spreadsheets, Causal streamlines the financial modelling process, allowing businesses to compare versions, manage cash flow, and prepare for fundraising.

Casual is perfect for businesses looking to perform financial modelling and scenario planning. Whether you’re a startup or an established company, Causal can help you streamline your financial modelling process, save time, and improve the accuracy of your financial planning.

Features:

- Cloud-based software for financial modelling and scenario planning

- User-friendly platform to build models, connect them to data, and share them with interactive dashboards and visuals

- Direct connection to data for up-to-date models

- Real-time collaboration with team members

- Interactive dashboards and beautiful visuals for presenting data

Benefits (Pros):

- Streamlines financial modelling process

- Improves accuracy of financial planning

- Saves time and effort

- Perfect for businesses of all sizes

- Easy-to-use interface

Cons:

Limited flexibility: While the platform offers a user-friendly interface for building financial models, some users may find it limiting in terms of customization and advanced features

Pricing:

Causal offers a range of pricing plans to meet the needs of businesses of all sizes. The platform offers a 14-day free trial for all its plans.

- Free – $0 plan

- Startup plan – $250 per month

- Business plan for customized pricing.

2. Oracle’s Primavera Unifier

Oracle’s Primavera Unifier by Oracle is a cloud-based solution designed to manage projects and facilities in any industry. It offers a range of features including cost management, document management, schedule and resource management, and more.

The platform also has strong business process automation capabilities that cater to the enterprise-grade control of capital programs.

Primavera Unifier offers ultimate configurability and governance, allowing users to automate any process with total control and data ownership.

It provides a comprehensive solution for the entire project lifecycle, from planning to asset management, and offers real-time enterprise visibility. The platform is also easy to use and offers multilevel hierarchies for modelling programs, portfolios, facilities, and assets.

Some key benefits:

- Cloud or on-premise deployment

- Best-in-class cost control capabilities

- Full earned value management analysis

- Completely integrated and user-friendly collaboration

- Easy monitoring, visualization, and adjustment of plans based on financial forecasts

Cons:

One possible drawback of using Primavera Unifier is its complexity. The platform is designed to handle complex projects, which means that it may take some time for users to learn how to use it effectively.

Pricing:

Oracle’s Primavera Unifier offers customized pricing based on the needs of your business.

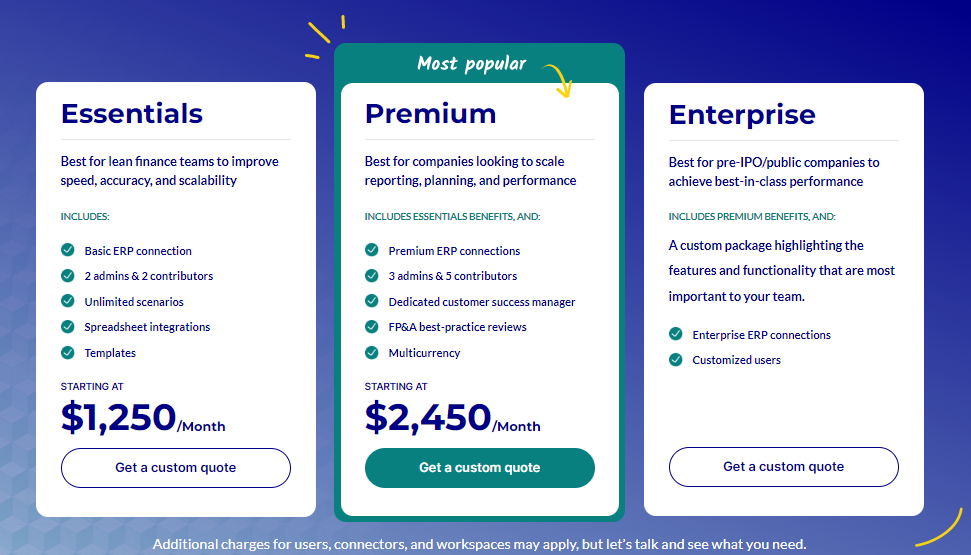

3. Cube

Cube is a cutting-edge FP&A platform that allows users to access data from spreadsheets in real time. With validations, user controls, and an audit trail, you can rest assured that your data is secure and accurate.

Cube is designed to provide FP&A teams with faster and more strategic planning, reporting, and analysis capabilities. Its key benefits include saving time, reducing errors, and improving insights.

Cube pairs the flexibility and familiarity of your spreadsheet with the control and scale of performance software, enabling teams to get started quickly and easily. Cube offers a comprehensive range of features to support your financial planning and analysis needs.

Key Features:

- Easy and efficient access to real-time financial and operational data

- Enhanced security through validations, user controls, and an audit trail

- Faster and more strategic planning, reporting, and analysis capabilities

- Time savings, reduced errors, and improved insights

- Flexibility and familiarity of the spreadsheet with the control and scale of performance software

Cons:

- One potential disadvantage of Cube Software is the difficulty in uploading and arranging your operating model to be coded and uploaded to Cube.

- This process may take more effort and time than expected, which could be a challenge for some users.

Pricing:

Cube Software offers 3 different pricing editions, ranging from $1,250 to $3,750.

4. Acterys

Acterys is a cloud or on-premise-based service that enables business users to generate professional data models integrating all relevant data sources with connectors to a variety of accounting systems and other sources.

With Acterys, users can build effective xP&A and performance management processes in Power BI, Excel, web browsers, and mobile devices using a variety of templates (Cost Center, Management Consolidation, HR, CAPEX, Cash Flow, etc.). The ability to review and update data directly from Power BI is one of the main selling points of Acterys.

Acterys is an excellent solution for businesses looking to improve their planning and analysis processes, achieve greater accuracy and consistency in financial reporting, and make better data-driven decisions.

Key Features:

- Centralized data model and logic for consolidation and grouping

- Wide variety of templates available for customization

- Integration with a variety of accounting systems and other data sources

- Simplified and streamlined planning and analysis processes

- Direct data review and update capabilities from Power BI

- User-friendly interface for ease of use

- Cloud or on-premise deployment options to fit business needs

Pros:

- Great value, easy implementation, and fits naturally with Microsoft products

- Enables writeback from Power BI and Excel

- Provides seamless data connection to Xero for efficient analysis

- Offers useful visuals such as Matrix, Table edit, Comments, Variance, etc.

- Out-of-the-box data integration reduces reliance on external support

- Flexible capabilities for various financial and business planning needs

- Leverages existing Microsoft products and internal capabilities for fast implementation

Cons:

- Workflow implementation can be challenging at times.

- Mastery of the solution may require external support and can be difficult for some users

Pricing:

Acterys offers trial/premium subscriptions. The trial allows users to try the solution without a credit card.

- Paid plans start from $55.00/month

- No free plans are available, but a trial is offered

5. Vena

Vena is a complete planning platform designed for business leaders and finance professionals to Plan To Grow™.

With over 1,300 leading companies and over 100 world-class partners using Vena, it offers a familiar and flexible Excel interface that enables users to input actual financial data, automate workforce planning, and link various data sources.

Vena’s time-saving automation features and collaboration with world-class partners make it a popular choice for businesses seeking to improve their planning capabilities.

The platform is easy to use and implement, with consultants and success managers available to ensure businesses can successfully integrate it into their operations.

Key Features:

- With Vena, you can plan to grow in a way that empowers you as a business leader or finance professional.

- The Excel interface makes it easy for you to input actual financial data, automate workforce planning, and link various data sources.

- The time-saving automation features of Vena, along with its collaboration with world-class partners, make it a popular choice for businesses like yours seeking to improve their planning capabilities.

- With consultants and success managers available to ensure you can successfully integrate Vena into your operations, you can trust that Vena will help you achieve your growth goals.

- Vena is an industry-standard tool that can be customized to meet your specific needs, including expandable capabilities like revenue forecasting.

- By using Vena, you can streamline your daily tasks, save time, and gain the insights you need to plan and grow your business with confidence.

Pros

- Vena is flexible, user-friendly, and shortens the budget process while improving reporting and process management.

- It allows for the storage of any data set and customization of data pulls for unique requests.

- Vena automates reporting, budgeting, and forecasting, freeing up FP&A teams for value-added projects and analysis.

- It saves time and increases accuracy with workflow management and tracking.

- Vena’s Excel-based platform eliminates manual consolidation and simplifies complex processes.

Cons

- Setting up templates and implementation can take longer than anticipated.

- The learning curve can be steep for those unfamiliar with the technology.

- The platform can run slowly at times.

Pricing

Vena offers two pricing plan which is the professional and complete plan. You might have to speak to their expert for custom pricing. A free trial is available.

6. Invoiced

Invoiced is an exceptional cloud-based solution that helps small and mid-sized businesses automate their accounts receivable.

It is a highly customizable platform that streamlines the billing, collections, payment acceptance, cash application and other aspects of the A/R process.

Invoiced is designed to be user-friendly and can be used as a standalone system or integrated with virtually any ERP or accounting software. Compared to other similar solutions.

Invoiced offers a more intuitive and comprehensive approach that eliminates the need for unnecessary features and functionality, resulting in a simpler and more efficient implementation.

Key Features

- Highly customizable A/R and A/P automation platform

- Can be used as a standalone or integrated with any ERP or accounting software

- Simplified implementation with no unnecessary features or functionality

- All-in-one platform for receivables and payables

- User-friendly interface for easy invoicing and payment processing

- Secure payment storage for automatic payments and one-off transactions

- Detailed reports for tracking income and end-of-year totals

Pros

- User-friendly and easy to operate

- Responsive and helpful customer service team

- Central location for tracking all client invoices

- Intuitive and easy-to-navigate software

- Saves time and reduces stress by automating financial processes.

Cons

- No mobile app version

- Limited flexibility in integrating with other payment platforms, including cryptocurrency

Pricing

Invoiced offers a free plan with limited features. For premium and custom pricing, reach out to them.

7. Tesorio

Tesorio is a Cash Flow Management solution that uses machine learning to improve collections forecasting and reduce DSO. It automates AR/Collections, AP, and FX Exposures and provides a dashboard and customer insights module to view cash trends, collections effectiveness, and invoice bucket composition trends.

It has a best-in-class dunning letter process and invoice tagging and is affordable, paying for itself within 6 months.

Tesorio Accounts Receivable reduces DSO, improves collections efficiency, decreases time spent on low-value dunning activities, and increases customer-base reached. It connects with various ERP systems and offers periodic collection estimates based on historical data.

Key Features

- Cash Flow Management Solution

- Machine Learning

- Collections Forecasting

- Automated AR / Collections, AP, and FX Exposures

- Dashboard and Customer Insights Module

- Dunning Letter Process and Invoice Tagging

- Affordable Solution

- Customer Service Team Support

Pros

- User-Friendly Platform

- Easy to Modify Dunning Notices and Statements

- Existing Dashboards and AI Data Analytics

- Spot-on Collection Estimates Based on Historical Data

- Direct Communication with Customers through the Platform.

Cons

- Some features need improvements, such as dedicated space for individual contributors and more accurate reporting.

- Search function can fail due to excessive data.

Pricing

Tesorio has not disclosed the pricing information for their product or service, which is a common practice among software sellers and service providers. To get the current pricing details, you can reach out to Tesorio directly.

8. Anaplan

Anaplan is a cloud-native SaaS platform designed to optimize business planning and performance management for various functions including finance, marketing, sales, supply chain, and workforce.

The platform offers planning tools that can be used for budgeting, forecasting, modelling, pricing optimization, analysis, and other planning and management tasks.

Anaplan’s proprietary Hyperblock™ technology allows real-time performance contextualization, forecasting of future outcomes, and agile decision-making across the enterprise for faster business transformation and innovation.

Key Features

- Offers a cloud-native SaaS platform for business planning and performance management across various functions.

- Enables real-time performance contextualization, forecasting, and agile decision-making across the enterprise.

- Provides a single source of truth for planning and decision-making through data integration and analysis within a unified platform.

- Offers various features including platform customization, integration APIs, internationalization, user, role, and access management, performance, mobility, reporting, dashboards, financial insight, forecasting, planning, data visualization, data analysis, real-time data updates, collaboration, optimization, and data.

PROS

- Reporting and dashboards for clear visibility and insights

- Financial insight for optimized financial planning and performance management

- Real-time data updates for up-to-date information

- Collaboration for team planning and decision-making

- Optimization for continuous business improvement

Cons

- Dashboarding limitations, particularly when pulling multiple dimensions together on a report

- New UX capabilities can still be enhanced

- Reporting part can grow in complexity and possibilities

Pricing

Anaplan provides three pricing options: Basic, Professional, and Enterprise. However, the cost of Anaplan may pose a challenge for clients who do not have a sustained and ongoing use for it.

9. Planful

Planful, a cloud-based financial performance management platform provides businesses with a comprehensive suite of tools for planning, budgeting, consolidating, reporting, and visual analytics.

With more than 1,000 customers around the world, Planful empowers users to confidently plan, close faster, and report accurately.

The platform is highly customizable and easy to use, making it a popular choice for businesses of all sizes and industries

Key features of Planful:

- Cloud-based financial performance management platform

- Comprehensive suite of tools for planning, budgeting, consolidating, reporting, and visual analytics

- Highly customizable and easy to use

- Annual compliance audits for regulatory requirements

- AES-256 encryption to protect customer data

- 99.5% uptime guarantee

- Business continuity and disaster recovery plans

- Seamless integration with existing data sources

PROS of Planful

- User-friendly interface

- Excellent customer support and comprehensive training

- Low-code solution to administration

- Streamlined business-wide planning, budgeting, consolidations, reporting, and visual analytics

- Highly customizable for front-office and production teams

- Adherence to last-minute requests from senior leadership and the board

- Ability to diagnose and resolve issues on your own

- Easy integration with existing data sources

CONS

- No way to organize scenarios into a structure

- Wait time for duplicating and creating scenarios can be slow

- Inability to edit directly in the formula bar of column/row sets.

Pricing

Planful offers customized pricing based on the needs of your business. Contact Planful for current pricing information as it is not disclosed publicly.

Why do Small Businesses Need Cash Flow Planning Software?

Cash flow planning software is a valuable tool for small businesses for several reasons. Firstly, it provides better financial visibility, which allows small businesses to keep track of their finances more efficiently.

By providing real-time financial information, cash flow planning software helps small businesses make informed financial decisions.

Secondly, cash flow planning software helps small businesses forecast their cash flow more accurately. With reliable cash flow projections, small businesses can plan their expenditures and investments more effectively.

Finally, cash flow planning software helps small businesses manage their expenses and revenue more efficiently. By automating financial processes, cash flow planning software reduces errors and eliminates the need for manual data entry.

The Benefits of Cash Flow Planning Software for Small Businesses

Cash flow planning software offers several benefits for small businesses.

Firstly, it improves financial efficiency by streamlining financial processes, reducing the time and effort required for financial management. This increased efficiency translates into significant cost savings for small businesses.

Secondly, cash flow planning software reduces errors in financial data entry, which improves financial accuracy. This improved accuracy helps small businesses make better financial decisions.

Finally, cash flow planning software enables better financial planning and management by providing small businesses with reliable financial information and forecasts.

Cash Flow Planning Software Summary

Cash flow management is critical for the success of small businesses.

Cash flow planning software can help small businesses overcome financial management challenges by providing better financial visibility, forecasting cash flow more accurately, and managing expenses and revenue more efficiently.

The benefits of using cash flow planning software for small businesses include improved financial efficiency, increased financial accuracy, and better financial planning and management.